My debt to income ratio

In general the lower the percentage the better the chance you will be able to get the loan or line of credit you want. Say your gross monthly income is 6500 and your debt payments total 3000.

Fha Requirements Debt Guidelines

When you apply for credit lenders evaluate your DTI to help determine the risk associated with you taking.

. The debt-to-asset ratio shows the percentage of total assets that were paid for with borrowed money represented by debt on the business firms balance sheet. A companys debt-to-asset ratio is one of the groups of debt or leverage ratios that is included in financial ratio analysis. Graphic showing how to calculate debt-to-income ratio.

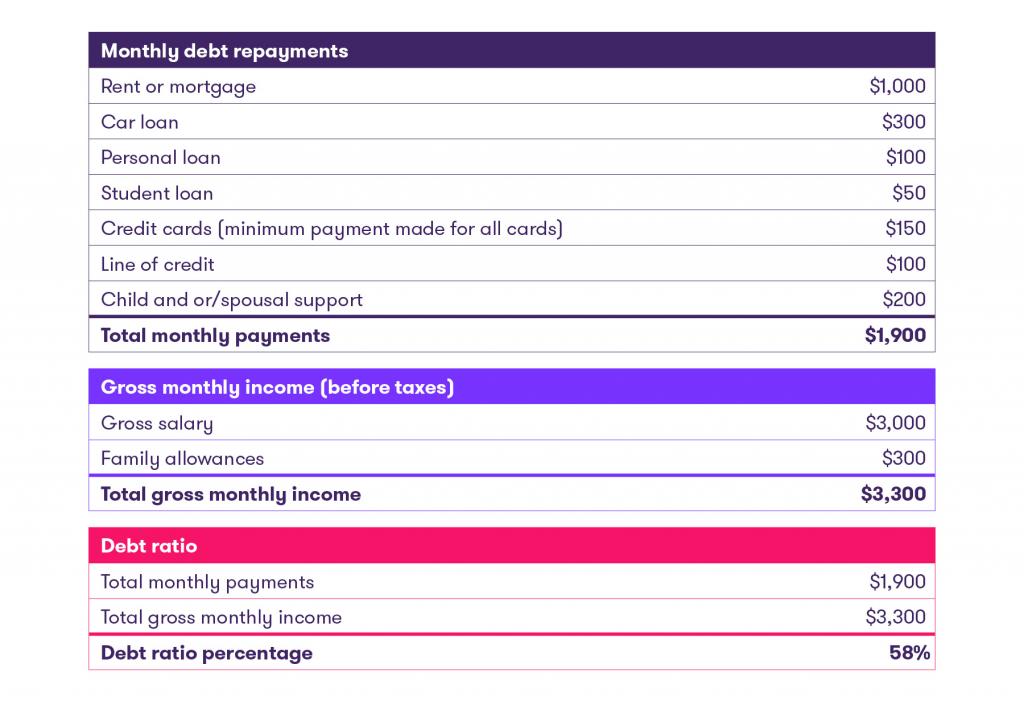

Monthly debt payments monthly gross income X 100 DTI ratio For example your income is 10000 per month. 37 to 42 isnt a bad ratio to have but it could be better. Debt-to-Income Ratio in the Credit Analysis Process.

Mortgage professionals use 2 main ratios to decide if borrowers can afford to buy a home. 1 Add up the amount you pay each month for debt and recurring financial obligations such as credit cards car loans and leases and student loans. This includes credit card bills car.

Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Gross Debt Service GDS and Total Debt Service TDS. The debt-to-GDP ratio allows you to compare debt levels between countries.

Ad Get Your Best Interest Rate for Your Mortgage Loan. Most lenders look for a ratio of 36 or less although there are exceptions. The debt-to-income DTI ratio is a key financial metric that lets lenders know how much of a borrowers monthly gross income goes into paying off their current debt.

Your credit score is based on your consumer credit. The debt to asset ratio is commonly used by creditors to determine the amount of debt in a company the ability to. Credit history and score.

Remember the DTI ratio calculated here reflects your situation before any new borrowing. The loans have repayment terms of three to 72 months. Is My Debt-to-Income Ratio Too High.

The lower your debt-to-income ratio the better your financial condition. Though each situation is different a ratio of 40 or higher may be a sign of a credit crisis. In this example we will calculate the Debt Service Coverage Ratio of Company C.

The higher the ratio the greater the degree of leverage and financial risk. It must not exceed 39. GDS is the percentage of your monthly household income that covers your housing costs.

Divide monthly debt payments by gross monthly income to get DTI Lets consider an example. RD Expense is 25 of the firms SGA Expense. Use the following information and the income statement.

As your debt payments decrease over time you will spend less of. The debt-to-income ratio is one. Be sure to consider the impact a new payment will have on your DTI ratio and budget.

It is an indicator of financial leverage or a measure of. You may have trouble getting approved for a mortgage with a ratio above this amount. Germanys debt-to-GDP ratio was less than 64 while Greeces was nearly 193.

Dont include your current mortgage or rental payment or other monthly expenses that arent debts such as phone and electric bills. What is the Debt to Asset Ratio. Compare Quotes Now from Top Lenders.

Manually underwritten FHA loans allow for a front-end maximum of 31 and back-end maximum of 43. Is all debt treated the same in my debt-to-income ratio. Youre probably doing OK if your debt-to-income ratio is lower than 36.

If they had no debt their ratio is 0. For credit scores above 580 and if other compensating factors are met the DTI ratio may be as high as 4050. It is important to note that for example an individual with a DTI ratio of 15 does not necessarily possess less credit risk than an individual with a DTI ratio of 25.

The Debt to Asset Ratio also known as the debt ratio is a leverage ratio that indicates the percentage of assets that are being financed with debt. As a quick example if someones monthly income is 1000 and they spend 480 on debt each month their DTI ratio is 48. This calculator will give you both.

The better your credit score the better your borrowing options may be. The more debt you have the higher your DTI and the harder it may be to qualify for. For example Germanys public debt is many times larger than Greeces but its 2017 GDP was 42 trillion much more than Greeces 299 billion.

Graph and download economic data for Household Debt Service Payments as a Percent of Disposable Personal Income TDSP from Q1 1980 to Q1 2022 about payments disposable personal income percent debt households personal services income and USA. You must earn an after-tax income of at least 1000 per month to be eligible. Receive Your Rates Fees And Monthly Payments.

Shows what portion of your income is needed to cover all of your monthly debt obligations plus your mortgage payments and housing expenses. This number is arisen when they plan to finance their new house new car or others. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income.

If your debt-to-income ratio falls within this range avoid incurring more debt to maintain a good ratio. The debt-to-income ratio is used as part of the credit analysis process to determine the credit risk of an individual. Lenders calculate your debt-to-income ratio by dividing your monthly debt obligations by your pretax or gross income.

Debt-to-income ratio is a personal finance measure that compares the amount of money that you earn to the amount of money that you owe to your creditors. If your ratio falls in this range you should start reducing your debts. Lenders calculate your debt-to-income ratio by using these steps.

Ultimately your total recurring debt influences your debt-to-income ratio and can improve or lower your chances of getting qualified for a mortgage. Get Offers From Top Lenders Now. Your mortgage property taxes and homeowners insurance is 2000.

A low debt-to-income ratio demonstrates a good balance between debt and income. Get the latest financial news headlines and analysis from CBS MoneyWatch. Debt-To-Income Ratio - DTI.

Any financial institutions or banks usually calculate it to determine your mortgage affordability. The ratio doesnt weigh the type of debt differently. Gross monthly income refers to the sum total of your monthly earnings before taxes and deductions.

In addition to your credit score your debt-to-income DTI ratio is an important part of your overall financial healthCalculating your DTI may help you determine how comfortable you are with your current debt and also decide whether applying for credit is the right choice for you. The maximum debt-to-income ratio for FHA loans is 55 when using an Automated Underwriting System AUS but may be higher in some cases.

Debt To Income Ratio Dti What It Is And Why It Matters Climb Credit

What Is Debt To Income Ratio And How To Calculate It Loans Canada

Debt To Income Ratio Debt To Income Ratio Home Buying Process Real Estate Information

What Is Debt To Income Ratio And Why Does It Matter Credit Karma

:max_bytes(150000):strip_icc():gifv()/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

![]()

What Is Debt To Income Ratio And How To Calculate It Loans Canada

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

What Is Debt To Income Ratio And Why Does It Matter Consumerfinance Gov Youtube

What Is The Debt To Income Ratio Learn More Citizens Bank

Debt To Income Dti Ratio What S Good And How To Calculate It

How To Calculate Debt To Income Ratio

How To Calculate Your Debt To Income Ratio Lendingtree

How To Calculate Debt To Income Ratio Credit Karma

Calculating And Understanding My Debt Ratio Raymond Chabot

Debt To Income Ratio What It Is And Why It Matters

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio Calculator Consolidated Credit Canada